Engaging with industry analysts is, of course, important to technology companies — they influence customers’ buying decisions; define, articulate and shape industry trends; and impact vendors’ reputations in the market. Analysts also provide valuable product-roadmap feedback, messaging guidance and competitive intelligence.

For many vendors — particularly those with offerings spanning multiple technologies/markets — it’s not uncommon to track and be relevant to hundreds (and hundreds) of analysts. That number is likely increasing too; the U.S. Bureau of Labor Statistics projects 18% growth in market analyst employment from 2019-2029 (amounting to 130,000+ new jobs).

In a perfect world, you could give all industry analysts as much personal attention as needed, so they’re well-educated about your company, its value proposition and customer successes. In reality, though, engaging individually and extensively with each relevant analyst isn’t possible or practical. For starters, chances are your AR team is stretched thin. The Institute of Influencer & Analyst Relations (IIAR>) reports that 63% of AR professionals are part of teams with fewer than five people.

Even beyond time and resource constraints, trying to engage every single analyst also isn’t strategic. It’s important for AR managers to tier the analysts on their outreach lists, so they prioritize developing and fostering the analyst relationships that most directly and significantly impact corporate goals.

How to Tier Analysts

When AR programs don’t have a systematic approach to prioritizing analysts, they often end up giving attention to the analysts who demand it — rather than concentrating on those who are truly important to the goals of the program. This can result in missed opportunities to “influence the influencers” who are most frequently engaging with your prospects and influencing their purchase decisions. By implementing a tiering procedure, you can allocate attention (both proactively and reactively) based on the impact and tier of each individual analyst.

Consider the following steps:

- Start with a broad list of relevant analysts, those that write about and speak to key topics in your market. Depending on your business, you may have multiple lists, based on product line. Tools and databases, such as ARInsights’ ARchitect, make it easy to search for, identify and stay on top of target analysts.

- Rank them by identifying your “Tier 1s.” These analysts are the ones that will have the greatest impact on your company’s objectives. They hold a lot of clout in your market, are often from major firms such as Gartner, Forrester and IDC, and can be from specialist firms as well. Their coverage areas directly intersect what you do, and if there’s a major report on your market (Magic Quadrant, Market Guide, Wave, etc.), they’re the ones writing it. These analysts also often speak to and guide end-users, present at relevant events, are quoted in the media and provide valuable advice to vendors. While it varies from company to company, many have four to five analysts designated as “Tier 1” for each major business area.

- Find your Tier 2s next. Tier 2 analysts are also often with major firms, but their coverage areas are more tangential to your company — for example, they may focus broadly on a specific vertical that your company serves, or a category, channel or persona that your company intersects with (e.g., an analyst focused on email strategies or CMOs would be of interest to a multichannel martech provider). Or, Tier 2 analysts might be lead analysts with relevant coverage to your business, though belong to smaller and more niche firms that aren’t quite as influential with prospects. Typically, there are fewer opportunities to influence and appear in your Tier 2 analysts’ research, but it’s still important and valuable to secure those opportunities, and drive visibility and awareness among those analysts. In addition, like Tier 1 analysts, Tier 2s can also help companies “move the needle” in multiple ways — providing advice, licensed research and other services.

- The rest are generally Tier 3s. That is, their coverage area is still relevant to your business; however, these analysts have less visibility into and impact on your direct market. Tier 3s typically are a large group. (It should be noted that some large organizations with a lot of relevant analysts will further separate them out into a Tier 4 or even a Tier 5 group.)

A few considerations as you develop your tiering: Your bands can be broad or narrow depending not only on where analysts are ranked, but also on how much time, money and resources your program has available. In most cases, it’s better to concentrate on thoroughly targeting a smaller number of analysts (using a narrow definition for Tier 1) and do that job well — rather than spread yourself too thin and compromise effectiveness among them all.

It’s also important to note that any set of tiers is a snapshot in time, not a permanent ranking. Because analysts may leave their firm or change their coverage, your company may alter its strategy, and your AR resources may change, your tiers should be considered a “living” and fluid ranking — and one that’s revisited periodically (such as twice a year) to ensure relevance.

At ARInsights, we provide Analyst Power 100 rankings — a look at the analysts who are generating the most “buzz” and interactions among ARchitect users. While your own analyst ranking and tiering system should be based on your specific business, industry and goals, this list can help validate your own efforts and impressions.

Allocating Resources Between Tiers

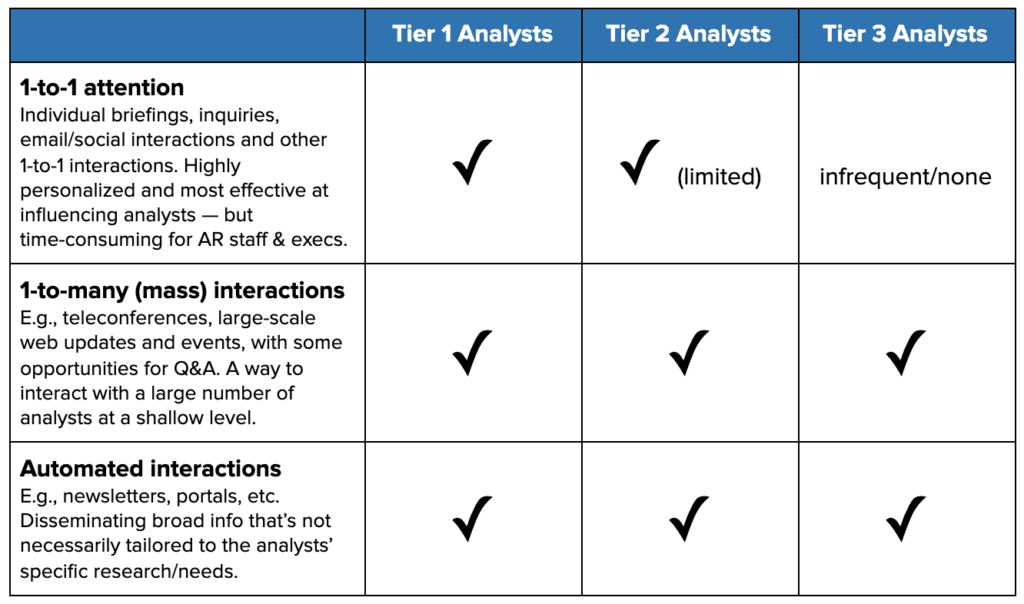

To best support their company’s goals, AR managers need to be strategic and relatively strict when it comes to allocating resources between the tiers of analysts. Organizations often find their AR programs have the greatest impact when they give Tier 1 analysts roughly 70 percent of their (and their executives’) overall attention and Tier 2 analysts about 30 percent. Tier 3 analysts generally receive any leftover time not used by Tier 1 or 2 targets, and also receive bulk/low-time updates.

To that end, content that is in AR newsletters or company portals, created primarily for Tier 1 or 2 analysts, can also be readily available to Tier 3 analysts, with little-to-no additional effort. ARInsights’ AR Portal solution, for example, provides an invitation-only, password-protected digital destination for analysts, where they can view curated content — such as briefing presentations, case studies, solution updates, corporate information and more — and opt in to be notified when new materials get posted. Well over 1,000 analysts log in to our clients’ portals on a regular basis — showing it’s an effective tool for reaching and informing analysts across tiers.

Many of our clients employ additional strategies and mechanisms for communicating across multiple analyst tiers — for example, including large groups of analysts in annual summits and conferences, and sharing links to analyst newsletters through social media.

The below table provides recommendations for how to divide your attention among tiers of analysts.

Bottom Line

- Through their research reports, market evaluations, direct conversations and recommendations, and more, analysts have a demonstrable impact on your prospects’ purchase decisions. They also provide actionable advice and intelligence to vendors.

- Rather than cater to all analysts, AR managers should create a tiering structure — allocating resources to the IT industry analysts who can most affect corporate AR goals.

- To support and implement the tiering process, it’s important to educate colleagues and executives on analyst influence and AR priorities.

- Periodically revisit and reevaluate your tiering structure to ensure you’re adhering to the standards you’ve set and maximizing effectiveness, and to ensure your analyst groupings are still appropriate.